We provide AI-powered cloud solutions that ensure full compliance with e-invoicing requirements, VAT reconciliation, and efficient automation of supply chain operations.

We provide AI-powered cloud solutions that ensure full compliance with e-invoicing requirements, VAT reconciliation, and efficient automation of supply chain operations.

issued in Phase Two

issuing e-invoices

We Have Served

in the KSA

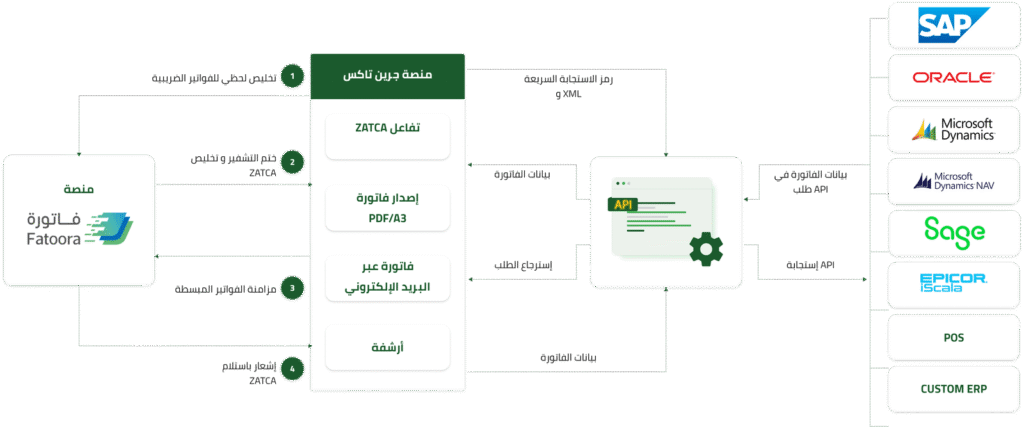

Our solution is meticulously designed to meet all regulations set by the Zakat, Tax and Customs Authority (ZATCA), ensuring your business stays ahead and fully aligned with government requirements.

Choose between on-premises deployment for full data control or a scalable on-cloud solution. Our robust API integration ensures seamless connectivity with your existing ERP systems.

With full Arabic language support and local expertise in Saudi Arabia, GreenTax® is built to address the unique challenges faced by businesses in the region.

Our in-house technical support team provides prompt assistance backed by extensive expertise, ensuring a smooth and hassle-free journey to e-invoicing.

Advanced APIs ensure a success rate of up to 99.98%.

Highly flexible infrastructure capable of processing thousands of e-invoices per second.

Smart and seamless integration with over 2,000 ERP and POS systems.

24/7 technical support.

We provide a dedicated account manager for support throughout the week, along with consulting services within Saudi Arabia.

We enable compliance with Zakat, Tax and Customs Authority (ZATCA) requirements easily, with minimal changes to your existing workflows.

Archiving in Saudi Arabia with a cloud or on-premises deployment model, according to the optimal choice for your business or organization.

greentax

Accurate detection of error-free e-invoices. Periodic error alerts. Smart correction suggestions with the ability to resend. Guidelines for batch error handling and resubmission.

100% compliance with Zakat, Tax, and Customs Authority standards. Continuous monitoring of updates to ensure ongoing compliance. Reliable solutions that enable efficient, error-free invoice processing.

Deep business insights through an advanced reporting system. Premium dashboards for effective information management. Automated and customized reports. Advanced filters for precise data analysis.

Continuous e-invoicing support ensuring full compliance with ZATCA requirements. Self-service options to submit and track support requests. Regular updates on products and ZATCA requirements. AI chatbot for instant query responses.

As experienced innovators, our team prioritizes customer satisfaction. We help and support our clients with a personal touch, guaranteeing professionalism at every step.

By providing your email, you agree to our privacy policy and Terms of service.