Future-proof your business with our ZATCA-compliant e-invoicing solution. Our on-premises and on-cloud platform simplifies regulatory compliance and drives digital transformation for businesses across Saudi Arabia and the MENA region.

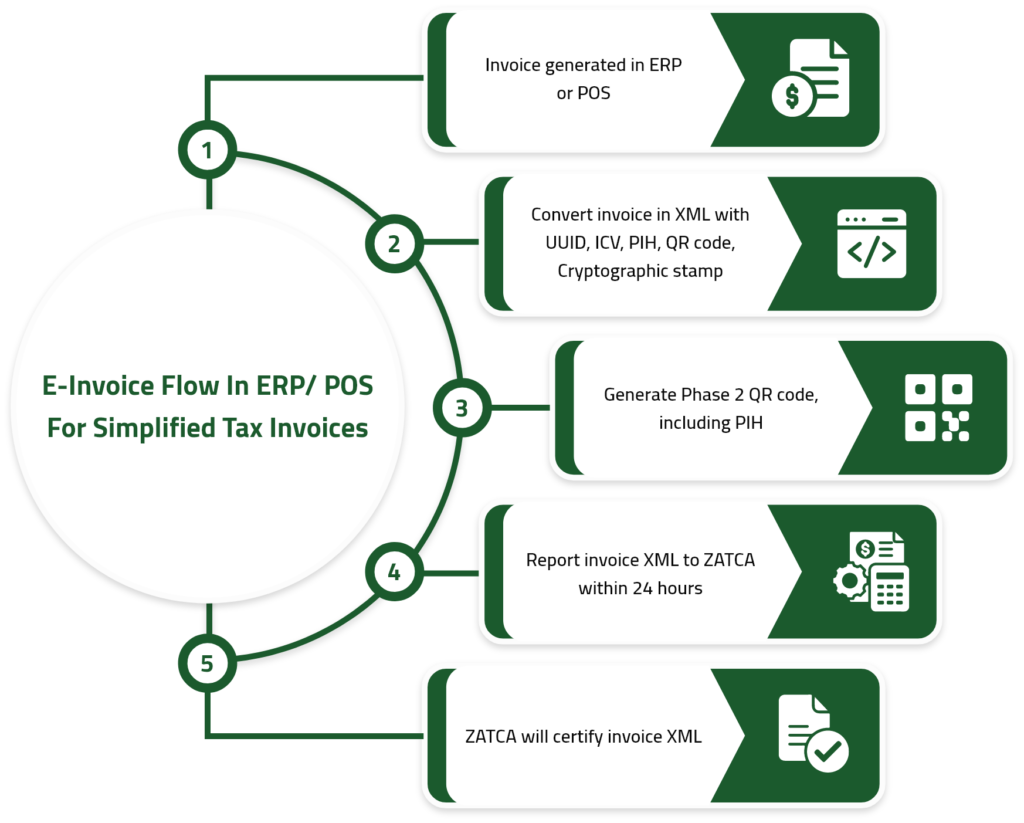

Our solution is meticulously designed to meet all ZATCA regulations, ensuring your business stays ahead of government mandates.

With full Arabic support and local expertise in Saudi Arabia, GreenTax® is built to solve the unique challenges of businesses in the Middle East.

Our in-house technical support team provides rapid, expert assistance, ensuring your e-invoicing journey is smooth and hassle-free.

Dedicated local account manager, advisory services and in-house technical support inside Saudi Arabian.

Supports multiple E-invoicing systems and our in-house team ensures a seamless process.

Advanced user access and archiving in line with the Saudi Arabian government regulations.

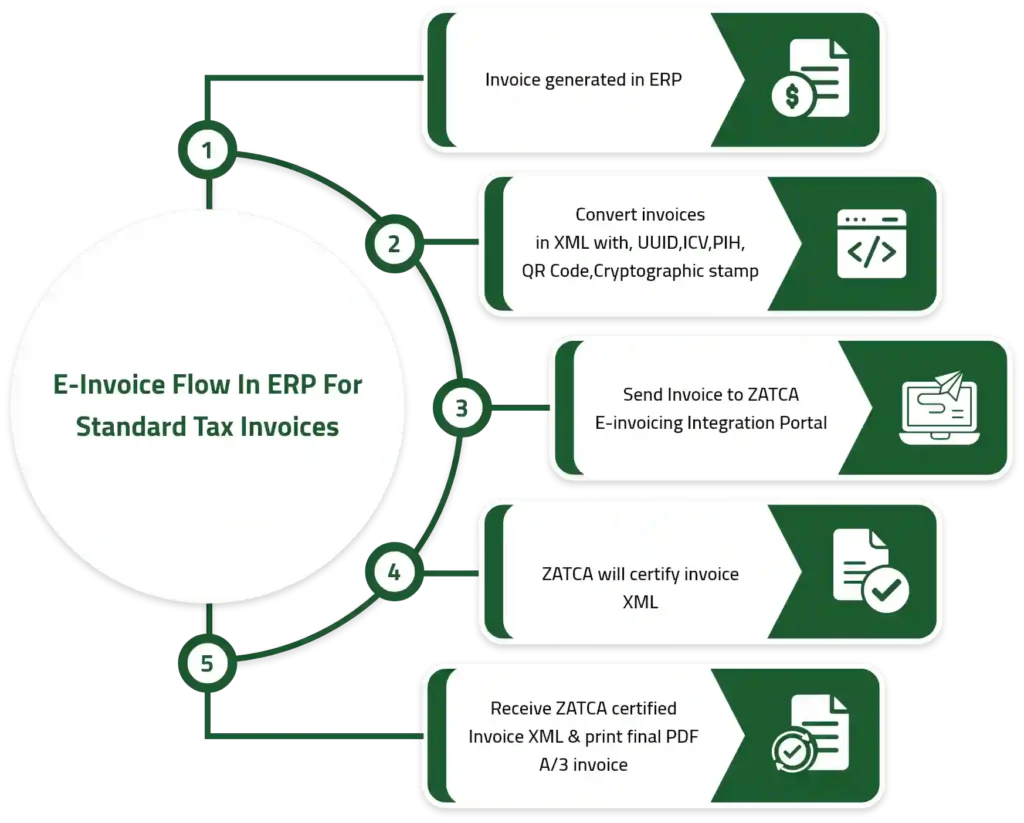

is the exchange of invoices between a supplier and a buyer in a digital format.

It’s a unique code issued for every E-Invoice (a combination of the supplier GSTIN, invoice number and financial year).

– B2B invoices issued by the supplier

– Debit notes issued by the supplier pertaining to B2B invoices

– Credit notes issued by the supplier pertaining to B2B invoices

– Occasional documents that could be required by ZATCA

An invoice is considered invalid without an IRN. In order for the IRN to be generated, it is advised that invoices be uploaded to the IRP in real-time.

Yes. Even if a business prints the invoice in its format, it still needs to contain the QR code returned by the IRP – as the QR code also contain the IRN.

No. With machine readability the QR code will enable easy validation of the contents of an E-Invoice.

Cancellation of an E-Invoice can be made within 24 hours post generation. Once cancelled, the same number cannot be used for any other invoice. As for the cancellation of an E-Invoice, it can be done using the acknowledgement number or IRN as per the availability.

In order for the GST network to validate and authenticate an electronic invoice, it must be submitted via a common e-invoice portal or invoice registration portal.

It’s applicable only for B2B transactions.

Speak with our experts and get a live demo of the GreenTax® platform. Let us show you how our solution can streamline your operations, ensure ZATCA compliance, and accelerate your business’s digital transformation.

As experienced innovators, our team prioritizes customer satisfaction. We help and support our clients with a personal touch, guaranteeing professionalism at every step.

By providing your email, you agree to our privacy policy and Terms of service.